Why You Must Test Your Strategy’s Sensitivity to Parameters

Because markets do not respect perfect calibration

A strategy that only works with one exact parameter setting is fragile by design. Change the lookback window slightly. Adjust the threshold. Move the stop level. If performance collapses, the strategy was never robust. It was tuned to the past, not built for the future.

Markets are noisy, unstable, and uncertain. Any edge that requires perfect precision to survive is unlikely to persist. Robust strategies do not depend on one optimal point. They operate across a reasonable range of parameters, where small errors do not destroy the signal.

This is why parameter sensitivity testing is not optional. It is one of the clearest ways to distinguish a real edge from a statistical illusion.

1. The Illusion of the Perfect Parameter

Optimization often creates a false sense of confidence. You scan a range of parameters, find a clear maximum, and assume you have discovered the optimal configuration. In reality, you may have only found the point that best fits past noise.

Lookback windows, thresholds, filters, stop levels. All of them are sensitive by nature. If the strategy’s performance depends on one exact value, it means the signal is tightly coupled to historical conditions that will not repeat in the same way.

A single Sharpe optimum is not a sign of strength. It is a warning. Robust edges do not require precision. They tolerate small mistakes because the underlying structure remains valid beyond one specific setting.

2. What Robustness Really Means

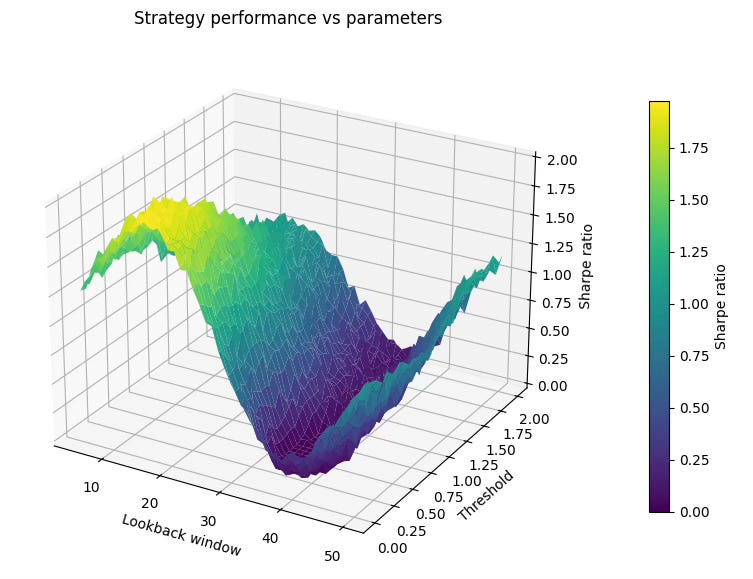

Robustness does not mean finding the best parameter. It means finding a region where the strategy behaves consistently. Performance does not need to be maximal. It needs to be stable.

A robust strategy works across a reasonable range of parameters. You can shift the lookback window, adjust the threshold, or slightly change the stop level, and the behavior remains coherent. Returns may vary, but the edge does not disappear.

This is the key distinction. Fragile strategies rely on precision. Robust strategies tolerate uncertainty. They accept that parameters are estimates, not constants. When performance survives small errors in assumptions, it has a chance to survive the future as well.

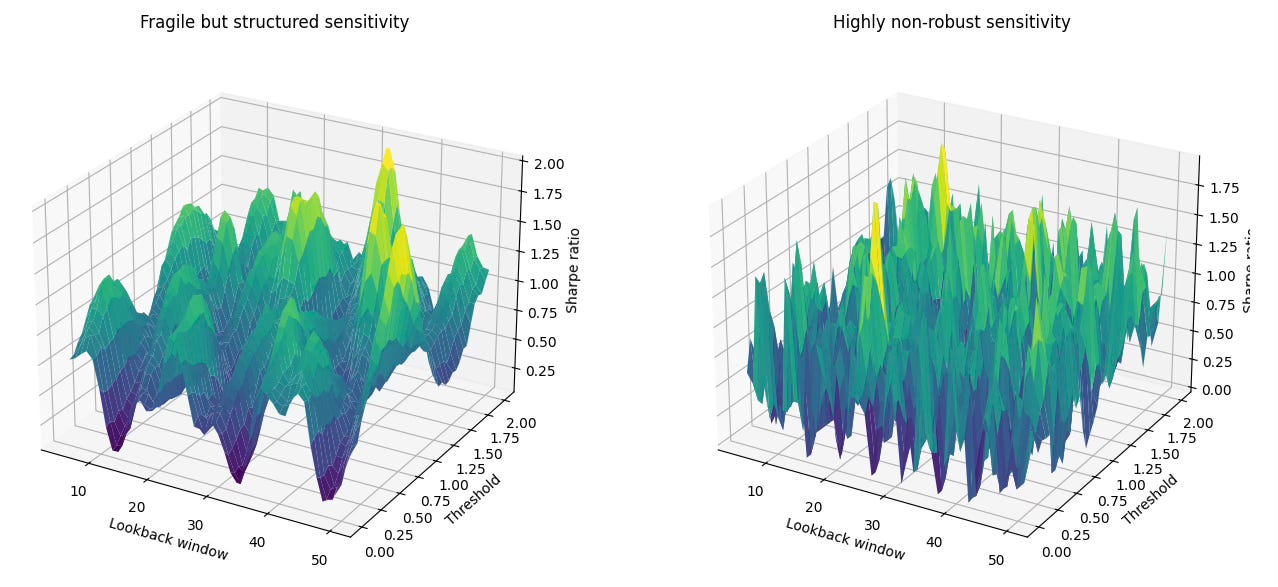

3. What Fragility Looks Like in Practice

Fragility appears when performance depends on very precise parameter choices. On the surface, the strategy may look acceptable. But once you explore the parameter space, the instability becomes obvious. Small changes lead to large swings in performance. Peaks are narrow. Valleys are deep. There is no continuity.

This behavior indicates that the strategy is not exploiting a stable market structure. It is exploiting coincidences in the historical data. The parameters are not tuning an edge. They are aligning the model with past noise.

In practice, this means the strategy has no margin for error. Any shift in volatility, regime, or execution conditions will move it away from the narrow zone where it appears to work. Strategies like this often perform well in backtests and fail quickly in live trading.

Fragility is not subtle once you look for it. It is visible in sharp peaks, abrupt drops, and highly irregular performance surfaces. When you see this pattern, the conclusion is simple. The edge is not robust.

👉 If you want to go deeper into each step of the strategy building process, with real-life projects, ready-to-use templates, and 1:1 mentoring, that’s exactly what the Alpha Quant Program is for.

Parameter sensitivity testing is not about finding the best setting. It is about verifying that an edge exists beyond one precise configuration. If performance only survives at a single point, the strategy is fragile by construction.

Robust strategies tolerate uncertainty. They work across a reasonable neighborhood of parameters, not because they are perfectly tuned, but because the underlying structure is real.

If you do not test sensitivity, you are not validating robustness. You are validating luck.