Strategies Generate Returns. Portfolios Control Risk.

Why the real edge is not a single strategy

Many traders spend years searching for the perfect strategy. One that delivers high returns, low drawdowns, and works in all market conditions. This strategy does not exist. Every trading strategy, even a good one, comes with risk. Periods of underperformance, drawdowns, and sensitivity to specific regimes are unavoidable.

A strategy’s role is simple. It generates returns. Risk management at the strategy level can limit damage, but it cannot eliminate uncertainty. If you try to reduce risk too aggressively within a single strategy, you usually end up reducing returns just as much.

Real risk reduction happens elsewhere. It happens at the portfolio level, by combining multiple strategies with different behaviors and low correlation. This is where risk is averaged out far more efficiently than returns.

1. What Strategies Actually Do

A trading strategy has a single purpose. It exploits a specific market behavior to generate returns. Nothing more. Nothing less. Even the most robust strategy is built around one idea, one source of edge, and one set of assumptions about how the market behaves.

Because of this, every strategy is exposed to risk by design. It performs well in certain conditions and struggles in others. Drawdowns are not a sign of failure. They are the cost of participation. Trying to eliminate them at the strategy level usually weakens the edge instead of making it safer.

A strategy can control how losses occur, but it cannot remove uncertainty. Risk is not something you can fully solve within a single strategy. It is something you have to manage at a higher level.

2. Why Risk Cannot Be Solved at the Strategy Level

When risk becomes uncomfortable, the natural reaction is to fix it inside the strategy. Tighter stops. More filters. Fewer trades. Lower exposure. These adjustments often make the backtest look cleaner, but they come at a cost. The expected return usually drops at the same time.

This happens because risk and return are linked at the strategy level. The edge exists precisely because the strategy accepts a certain type of uncertainty. Trying to remove that uncertainty internally often means removing the conditions that make the strategy profitable in the first place.

You can reshape the risk profile of a strategy, but you cannot neutralize it without damaging the edge. The risk does not disappear. It simply reappears elsewhere, through missed opportunities, lower returns, or increased sensitivity to specific regimes. This is why risk cannot be fully solved by optimizing a single strategy in isolation.

3. Diversification Across Strategies Is the Real Risk Lever

The most effective way to reduce risk is not to keep refining a single strategy. It is to combine several strategies that behave differently. What matters is not that each strategy is perfect, but that their returns are not highly correlated.

Each strategy reacts to different market conditions. One may perform well in trending markets, another in range bound environments, another during volatility expansions. When these strategies are combined, their drawdowns do not occur at the same time. Losses in one are often offset by gains or stability in others.

This is where portfolios become powerful. By mixing non correlated strategy returns, you average out unfavorable periods without averaging out the edge itself.

You must take a look to their behavior especially during crashes or specific events (that will make your portfolio even stronger).

The individual strategies still generate returns, but the portfolio smooths the path. Risk is reduced not by suppressing volatility inside a strategy, but by letting different sources of performance balance each other over time.

This is also why diversification across strategies is fundamentally different from diversification across assets. What matters is the behavior of returns, not the instrument being traded.

4. Why Portfolios Reduce Risk More Than They Reduce Returns

When you combine multiple non correlated strategies, something important happens. The portfolio return becomes smoother, but the average performance does not collapse. This is because diversification primarily acts on variance, not on the underlying edges.

Each strategy still contributes its own expected return. What the portfolio reduces is the impact of extreme outcomes. Large drawdowns from one strategy are diluted by the others. Volatility decreases faster than returns because bad periods are less synchronized.

This is why portfolios are so powerful. You do not need exceptional strategies. You need several decent ones that behave differently. Even simple allocations, such as assigning X percent to each strategy, are often enough to capture most of the diversification benefit (but of course, we can do much better using more complex methods).

At the portfolio level, risk is not eliminated, but it is transformed. It becomes more predictable, more stable, and easier to manage than the risk of any single strategy taken in isolation.

5. Simple Allocation Improves the Return to Risk Tradeoff

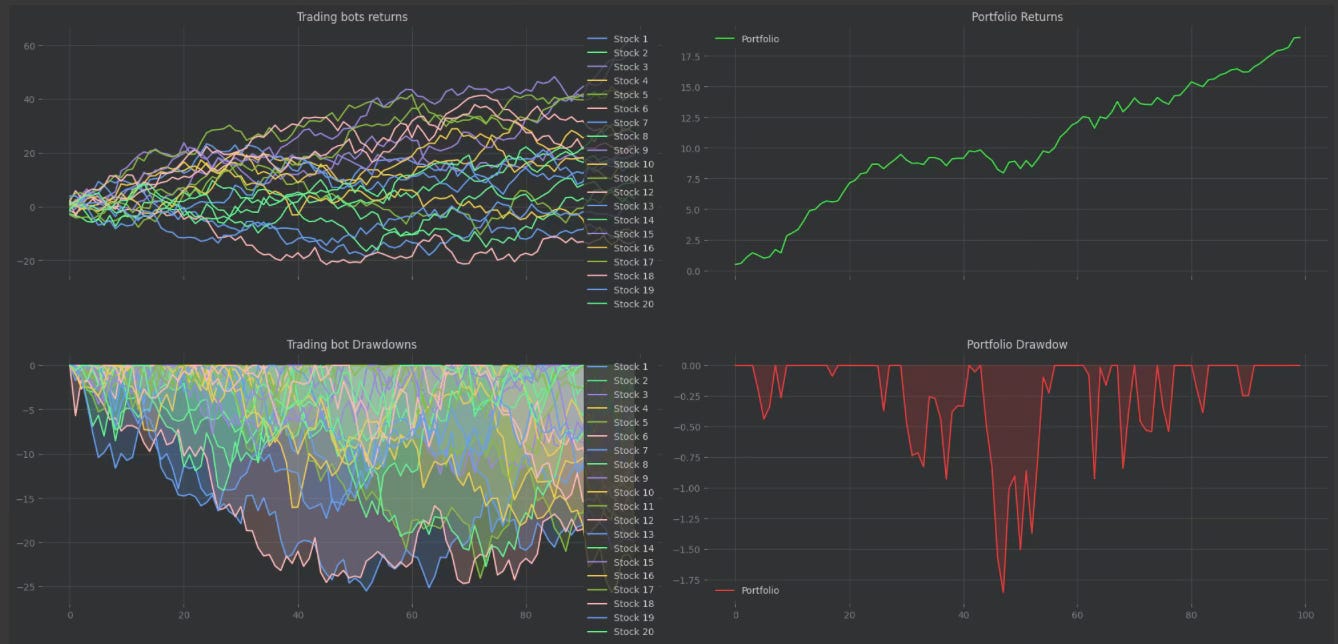

The chart makes the point very clearly. Individually, most strategies generate acceptable returns, but they come with deep and uneven drawdowns. Several strategies reach drawdowns well beyond minus 15 to minus 20 percent, sometimes while their final return remains modest. The return to drawdown ratio at the strategy level is therefore poor and highly unstable.

Now look at the portfolio built with a simple equal weight allocation, around 5 percent per strategy. The portfolio return becomes smoother, but more importantly, the drawdown profile changes completely. While individual strategies suffer large and frequent drawdowns, the portfolio drawdown remains shallow and short lived. The worst portfolio drawdown is small compared to the individual ones, even though the portfolio still compounds steadily.

This is the key result. The portfolio does not outperform the best individual strategy in absolute return, but it massively improves the return to drawdown ratio. Risk is reduced far more than returns. This is exactly what diversification across non correlated strategies is supposed to achieve.

No clever tuning is required to observe this effect. The allocation is simple, almost naive. Yet the improvement in stability and risk efficiency is obvious. This is why portfolio construction matters more than fine tuning individual strategies. The edge comes from how strategies interact, not from squeezing one strategy to perfection.

👉 If you want to go deeper into each step of the strategy building process, with real-life projects, ready-to-use templates, and 1:1 mentoring, that’s exactly what the Alpha Quant Program is for.

There is no perfect trading strategy. Strategies generate returns, but portfolios control risk. The most reliable way to improve performance is not to search for a single exceptional strategy, but to combine several decent ones with low correlation.

Simple diversification dramatically improves the return to drawdown tradeoff. Risk falls much faster than returns. This is where robustness comes from.

Makes sense conceptually, but ~5% per strategy implies ~20 of them. Finding one decent strategy is hard - finding 20 uncorrelated ones - yowza! (For me, anyway)

Curious how this compares to simpler approaches like Permanent Portfolio that diversify across regimes at the asset level instead?

Stacking strategies increase the fee/commissions.