Meta-Labelling Explained: Filter Noise, Boost Precision, Win More

Your Signal Isn’t Enough. Here’s What Really Decides the Trade

You’ve built a solid signal. Maybe it’s based on Bollinger Bands, trend-following logic, or momentum bursts.

You know when to enter. You know which side to take.

But let me ask you one thing:

How do you know if this trade is actually worth taking?

That’s where most traders stop — and where serious quants go one level deeper.

This is the job of Meta-Labelling.

Not to create more trades. But to decide, for every signal you generate:

“Is this one actually worth executing?”

In this newsletter, I’ll show you how meta-labelling turns noisy signals into cleaner decisions, filters out false positives, and becomes the true brain of your trading logic.

1. A Signal Is Not a Trade

Let’s get this straight:

Generating a signal doesn’t mean you should trade it.

Most strategies work like this:

“My signal says BUY → I enter.”

That logic is too simplistic, and it’s one of the main reasons why good ideas fail in live trading.

In real markets, not all signals are created equal.

Some have edge. Most don’t.

And without a second layer of validation, you’re trading blind.

That’s where meta-labelling enters the picture.

It doesn’t replace your signal, it sits on top of it.

Its job is to ask:

“Now that I’ve got a signal… is this the right time to act?”

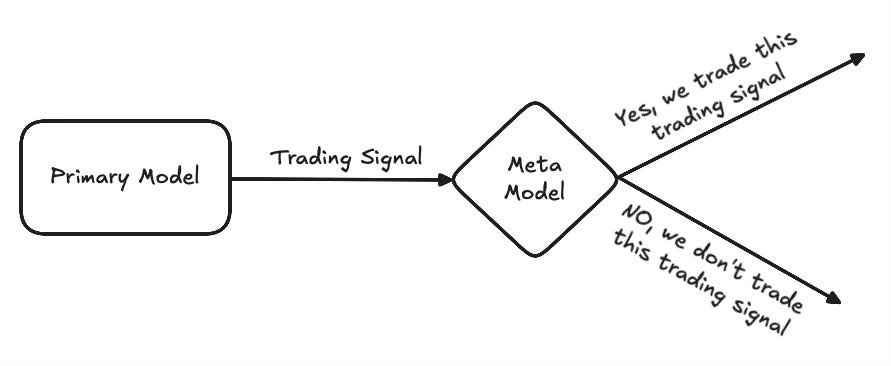

Primary model = opportunity generator

Meta model = opportunity filter

And this simple separation changes everything.

2. What Is Meta-Labelling?

Meta-labelling is a two-layered approach to trading decisions.

You split your logic into two distinct models, each with a specific job:

Primary model: detects where and in which direction to trade (long/short). It’s usually based on a simple rule — Bollinger breakout, moving average crossover, RSI threshold, etc.

Meta model: takes every signal from the primary model and predicts whether it’s actually worth executing or not.

The primary model frames the opportunity.

The meta-model decides whether you should act on it.

Think of the primary model as your radar. It spots potential setups.

But the meta-model is your filter. It decides which ones deserve attention — and which ones to skip.

The result?

You trade less, but trade better.

3. How It Works: From Signal to Smart Decision

To train a meta-model, you first need one thing: labels.

In other words, for each signal generated by your primary model, you must answer:

“In hindsight, was this trade a good one?”

That’s it. That’s the job of the label.

The most reliable way to do this is with the Triple-Barrier Method, which assigns one of three outcomes to each trade setup:

+1 → the trade hit the take-profit first

-1 → the trade hit the stop-loss first

0 → neither was hit before expiration (neutral)

But here’s what matters:

The triple-barrier is just one smart way to generate those labels.

What you really need is any logic that can say:

“This signal worked” / “It failed” / “It wasn’t worth entering”

Once labeled, these outcomes become the target variable for your meta-model.

Its job?

Learn the hidden patterns that distinguish good trades from bad ones, based only on the context at signal time.

That’s how you teach your model not to find trades, but to judge them.

4. Walkthrough: From Signal to Meta-Model

To show you how meta-labelling works in practice, we built a simple pipeline using the quantreo library and applied it to a synthetic OHLCV dataset.

Here's the logic, no code (but you can find the code here), just the steps:

Create a basic trading signal

We generated a buy signal whenever a short-term moving average (20-period SMA) crossed above a longer-term one (60-period SMA). This is a classic trend-following setup used to define potential entry points.Label the trades using the Triple-Barrier Method

For each signal, we applied the Triple Barrier Labeling (tp = 0.5%, sl = -0.5%, 150-bar horizon) using the quantreo target engineering module. It assigned:+1 if the trade hit the take-profit,

-1 if it hit the stop-loss,

0 if neither barrier was reached in time.

These labels became the target for our meta-model.

Generate features around the signal

We computed several volatility indicators (Close-to-Close, Parkinson, Rogers-Satchell, Yang-Zhang), price distribution bands, autocorrelation, and the Hurst exponent using the quantreo feature engineering module.

A volatility average was also computed to reduce dimensionality.Filter only buy signals

To make the meta-model relevant, we kept only the rows where our signal said to enter (i.e.signal == 1). These represent the "should we act?" decisions.Train a meta-model

We used a basic Support Vector Machine (SVC) to train on 75% of the data and test on the remaining 25%.Evaluate the Meta-Model

Once trained, we tested the meta-model on unseen data — and compared its predictions to the baseline strategy that executes every signal.

5. Results + Interpretation

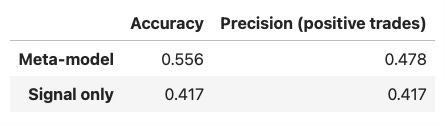

✅ Results

We compared the raw signal vs. the meta-model:

🔍 Interpretation

Despite being a minimal example with:

Less than 150 signals,

No robustness testing,

A basic train/test split,

…the meta-model still improved both accuracy and precision by filtering out some poor trades.

Of course, these numbers are not statistically significant. But they illustrate what meta-labelling is meant to do:

👉 Turn noisy signals into smarter decisions.

If you scale this process with more data, better features, and proper cross-validation, the performance gap could become a real edge.

Meta-labelling isn’t about creating more trades, it’s about trading better.

By adding just one extra layer of intelligence over a basic signal, we were able to filter out noise, reduce false positives, and improve decision-making. Even with a basic setup and small dataset, the impact was visible.

But this is only scratching the surface.

If you want to go deeper, build smarter features, understand signal reliability, and master techniques like triple-barrier labeling, walk-forward validation, or feature conditioning, that’s exactly what we cover in ML4Trading.

🚀 Whether you're coding your first models or scaling a live strategy, ML4Trading gives you the tools, templates, and theory to build robust and intelligent trading systems.

Thanks for reading, now it’s your turn to build the brain of your strategy.

Very interesting! Do you have any literature on how to prevent overfitting the meta-model? Or how to detect if I overfit the primary model or the meta model?