Look-Ahead Bias. The Invisible Killer!

Why strategies that look perfect on paper collapse in live trading

Look-ahead bias is one of the most dangerous errors in quantitative research because it rarely looks like a mistake. The backtest is clean. The metrics are stable. The equity curve is smooth. Everything suggests robustness. Yet the strategy was never tradable in the first place.

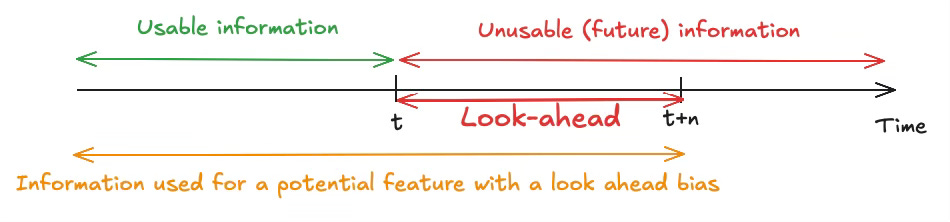

This bias appears when information from the future leaks into the decision process. Often unintentionally. A target slightly misaligned. A feature computed with data not available at the time. A normalization done on the full dataset. Each individual step looks reasonable. Together, they create a strategy that knows more than it should.

Look-ahead bias does not exaggerate performance randomly. It removes uncertainty by construction. And when uncertainty disappears, realism disappears with it.

1. What Look-Ahead Bias Really Is

Look-ahead bias occurs when a strategy uses information that was not available at the moment a decision was made. The trade appears valid in the backtest because the future has already been revealed. In live trading, that information does not exist yet, and the strategy collapses.

This bias is rarely obvious. It does not come from a single line of code that clearly looks wrong. It usually emerges from small misalignments in the research process. A feature that relies on a full window instead of past data only. A target that leaks future movement. A normalization step that quietly uses information from the entire sample.

The result is a strategy that reacts too well, too early. It seems to anticipate market moves because, in practice, it already knows them.

2. The Most Common Sources of Look-Ahead Bias

Look-ahead bias usually comes from the research pipeline, not from the trading logic itself. The backtest still looks clean, which is why these errors are so dangerous. Common sources include:

• Misaligned targets: Forward returns or event based labels that are not shifted correctly, allowing future price movements to leak into the learning signal.

• Feature computation errors: Rolling statistics or indicators that include future observations, end of period values used before they are known, or windows that are not strictly backward looking.

• Data normalization and scaling: Standardization, ranking, or normalization performed using statistics computed on the full dataset instead of using past data only.

• Feature selection leakage: Selecting features based on their performance over the full sample, including periods that should remain unseen.

• Improper validation methods: Using classical cross validation instead of time aware methods, which breaks the temporal structure and leaks future information into training.

Each of these steps may look reasonable in isolation. Together, they create strategies that unknowingly trade on future data.

3. How to Detect Look-Ahead Bias

Look-ahead bias is difficult to spot because it does not announce itself clearly. Detection requires suspicion, not optimism. If a strategy looks too stable, it deserves closer inspection. Here are practical ways to detect it:

• Check data availability at decision time: For every feature, target, and filter, ask a simple question. Could this value have been known at the exact moment the trade was placed ? If the answer is unclear, assume there is leakage.

• Enforce strict time alignment: Verify that all features use only past data and that targets are shifted correctly. A one step misalignment is enough to invalidate the entire backtest.

• Break the pipeline on purpose: Delay features or targets artificially and observe how performance reacts. A strategy that collapses under a small delay was probably relying on future information.

• Compare backtest and live logic: If the backtest pipeline cannot be replicated exactly in live trading, there is almost certainly a look-ahead issue.

• Test across assets and periods: Leakage often fits one asset or one regime extremely well. If performance vanishes when you change markets or time windows, realism was likely missing.

Look-ahead bias does not disappear by chance. It disappears when every step of the process is questioned and validated under real time constraints.

If you want to speed up your work with features that already capture robust market behaviors, the Quantreo library and the AI Trading Lab give you everything you need to enrich your data and restart your research with a much stronger foundation.

Look-ahead bias is not a small technical mistake. It is a fundamental violation of realism. A strategy affected by it may look stable, profitable, and well behaved in a backtest, yet it has no chance of surviving live trading.

The only reliable defense is a disciplined process. Every feature must respect data availability. Every target must be built with strict time alignment. Every validation step must preserve the temporal structure of the data. When realism is enforced at each stage, performance usually drops, but credibility increases.

In quantitative research, realism always matters more than performance. A weaker backtest that can be deployed is infinitely more valuable than a perfect curve that never could.