How to Think in Distributions, Not in Points

Why Single Numbers Create False Confidence

Most traders think in single numbers. One Sharpe ratio. One expected return. One drawdown. It feels precise, but it hides the reality of financial markets. The future is random, and every model, every backtest, every live trade has a full range of possible outcomes. A single number is only one sample from that range.

Thinking in distributions means accepting uncertainty instead of compressing it. It means asking what the possible results are, how wide the range is, and how often each scenario occurs. Robust strategies do not aim for the best outcome. They are built to survive the entire distribution of outcomes, including the parts that most traders prefer to ignore.

1. The Future Is Random. Your Model Must Accept It

Financial markets do not evolve along a single path. They generate a wide range of possible scenarios driven by volatility shifts, liquidity changes, structural breaks, and unexpected events. Even a robust signal behaves differently depending on the environment. This is what makes point thinking dangerous. It assumes a level of certainty that does not exist.

A strategy does not produce one return. It produces a distribution of returns. Some outcomes are good, some are acceptable, and some fall into the tail that most traders ignore. When you accept this, you stop treating a backtest as a fixed prediction and start seeing it as one sample among many possible futures.

A researcher that ignores randomness becomes fragile. A researcher that accepts randomness becomes realistic. Robust research begins when you recognize that uncertainty is not a flaw to remove but a property to measure and work with.

2. The Danger of Point Thinking

Point thinking reduces uncertainty to a single number. One Sharpe. One CAGR. One maximum drawdown. These metrics look objective, but they hide the fact that they are only one realization of a much broader range of outcomes. They give the illusion of control by compressing all variability into a single value.

This mindset creates weak decisions. Traders oversize positions because the backtest shows a single attractive path. They discard strategies that looked average even though their distribution was stable and resilient. They underestimate risk because they anchor on one drawdown instead of the worst scenarios that could have occurred with slightly different market conditions.

A point estimate is comfortable, but it is incomplete. It tells you nothing about how the strategy behaves in the tails, nothing about the variability between runs, and nothing about how sensitive the results are to small changes in parameters or regimes. A strategy that looks exceptional on a single path may collapse across a wider set of simulations.

When you limit your thinking to points, you train yourself to ignore the outcomes that matter most.

3. How to Think in Distributions

Thinking in distributions means shifting the question from “what is the return” to “what are the possible returns and how often do they occur”. You stop looking for a single answer and start evaluating the full set of outcomes that a strategy can generate.

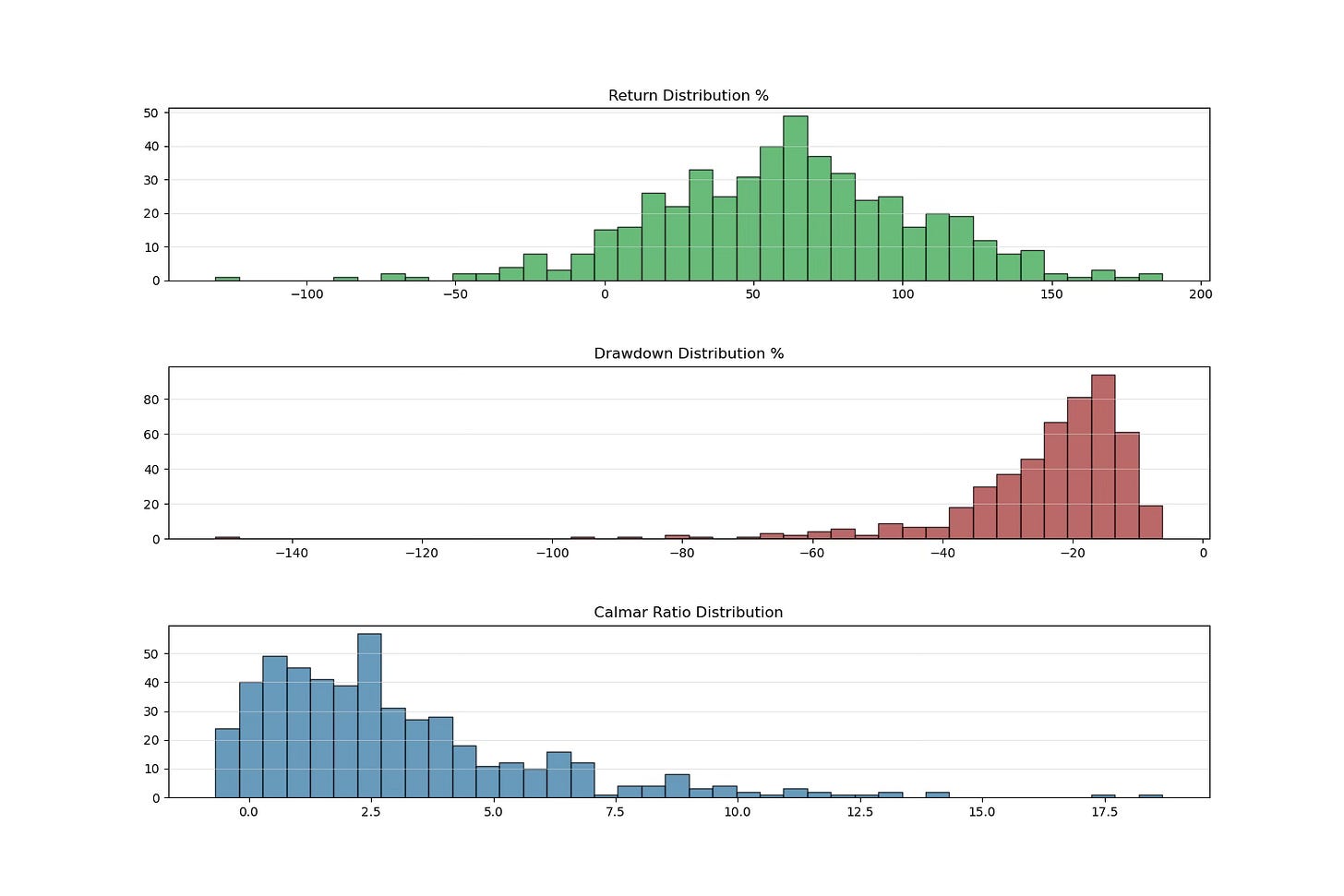

The idea is simple. Every strategy has a central tendency, a spread, and tails. You care about all three. The average tells you what is typical. The spread tells you how variable the results are. The tails tell you the price you pay when the market turns against you. A backtest cannot summarize this complexity with one number.

The right questions become clear.

What does the distribution of outcomes look like over multiple simulations or multiple assets.

How wide is the range of scenarios.

How often does the strategy produce acceptable returns.

How severe are the worst deciles.

What happens if volatility changes or a regime breaks.

Once you start thinking this way, fragility becomes obvious. Two strategies with the same Sharpe can have completely different risk profiles. One has a narrow distribution and tight tails. The other has a wide distribution with outcomes that include catastrophic losses. Only the first one is truly robust.

Understanding the distribution tells you how a strategy behaves in reality, not how it behaved on one convenient path.

—> To generate the different simulations that form the distribution, you can rely on several methods such as cross validation, Monte Carlo resampling, randomized parameter testing, or multi asset evaluation.

Trading is not about predicting a single outcome. It is about surviving a wide range of possible scenarios. When you think in distributions instead of points, you stop relying on one idealized backtest and start evaluating how a strategy behaves across many futures. This is how you identify signals that remain stable when volatility shifts, when regimes change, or when noise dominates.

Robust strategies do not aim for the best result. They aim for consistency across the entire distribution. They deliver acceptable outcomes across many paths instead of exceptional outcomes on one path. Once you adopt this mindset, your research becomes more realistic, your risk management becomes clearer, and your decisions become stronger.

👉 If you want to go deeper into each step of the strategy building process, with real-life projects, ready-to-use templates to generate distribution metrics, and 1:1 mentoring, that’s exactly what the Alpha Quant Program is for.