False negatives are better than false positives...

Why false negatives are often preferable to false positives in trading

In trading, not all mistakes are equal. Machine learning metrics often treat false positives and false negatives as symmetric errors. Markets do not…

A false positive creates a trade where no real opportunity exists. A false negative simply means staying out.

This asymmetry changes how models should be evaluated and how signals should be used in practice.

Understanding this difference is essential when dealing with noisy markets and rare trading opportunities.

1. False positives and false negatives are different by nature

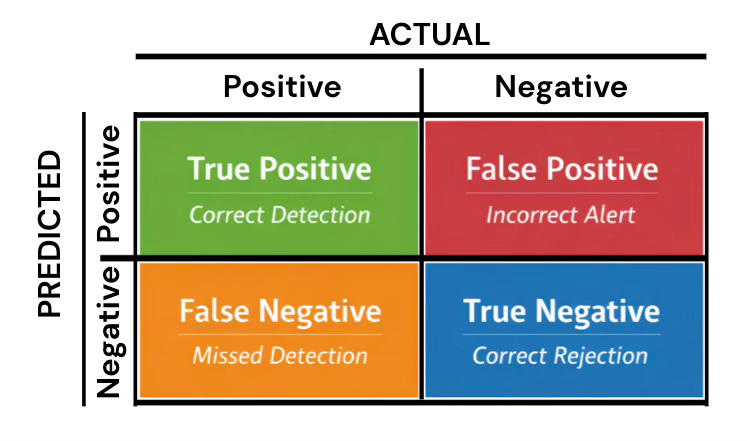

In any decision system, two types of errors can occur.

A false positive happens when a system signals that something is happening, while in reality nothing is happening.

A false negative happens when something is happening, but the system fails to detect it.

These two errors are not interchangeable.

Their impact depends entirely on the context and on what happens after the decision is made.

In some domains, false positives are preferred:

In natural disaster monitoring, issuing a tsunami alert that turns out to be unnecessary is often acceptable compared to missing a real one.

In medical screening, early detection systems may tolerate false alarms to avoid missing critical conditions.

In other domains, false negatives are preferred:

In credit risk decisions, rejecting a good borrower is often less costly than approving a bad one.

In legal and compliance systems, a false accusation can cause irreversible damage, while a missed case can often be reviewed later.

The key point is simple.

The cost of an error is not symmetric, and the preferred type of error depends on the consequences of acting or not acting.

Understanding this distinction is essential before choosing metrics, thresholds, or optimization objectives.

2. In Trading, acting has a cost

The critical difference between false positives and false negatives in trading appears after the signal is generated. A signal is not just a prediction. It is a decision to allocate capital.

When a false positive occurs, the system acts: a position is opened, costs are paid, capital is exposed to randomness, risk accumulates over time. Each false positive adds friction and noise to the strategy. These effects compound.

By contrast, when a false negative occurs, nothing happens: no position is taken, no cost is paid, no drawdown is created. The opportunity is missed, but the system remains stable.

This is why trading systems are fundamentally different from pure prediction systems.

The cost is not attached to being wrong. The cost is attached to acting when you should not.

This is also why being more selective often leads to more robust strategies, even if fewer opportunities are captured.

In trading, stability comes from controlling actions, not from predicting more events.

3. Why evaluation metrics push trading systems in the wrong direction

The problem is not only how trading systems behave, but also how they are evaluated.

Most machine learning metrics are designed for prediction tasks, not for decision systems with asymmetric costs.

Accuracy is the most common example. When events are rare, accuracy is largely driven by true negatives. A model can appear excellent simply by predicting “no signal” most of the time.

This gives a false sense of reliability.

Recall can be more informative, as it measures how many real opportunities are detected.

However, recall ignores what happens when the model is wrong in the other direction.

By construction, increasing recall often increases false positives. In trading, this trade-off is rarely neutral. Optimizing a metric in isolation pushes the system toward more actions, not necessarily toward better decisions.

This is why trading systems must be evaluated with metrics that reflect when capital is exposed, not just how often predictions are correct.

In trading, the objective is not to maximize precision or recall.

It is to trade only when acting is justified, and to act often enough for the strategy to matter.

👉 If you want to go deeper into each step of the strategy building process, with real-life projects, ready-to-use templates, and 1:1 mentoring, that’s exactly what the Alpha Quant Program is for.

Good stuff! But I’m not sure why you think predictions in a trading system are an exception. The cost of predictions are usually asymmetrical, and the cost is tied to the action. Predicting out-of-stock has asymmetric cost between expediting (action) and missing sales (inaction). Predicting transit time has an asymmetric cost between missing the event and dead waiting time (resulting from the action of when to leave).

Ami thinking about this wrong?