Alpha vs. Strategy: What’s the Difference?

Why formulas create signals, but only strategies create profits.

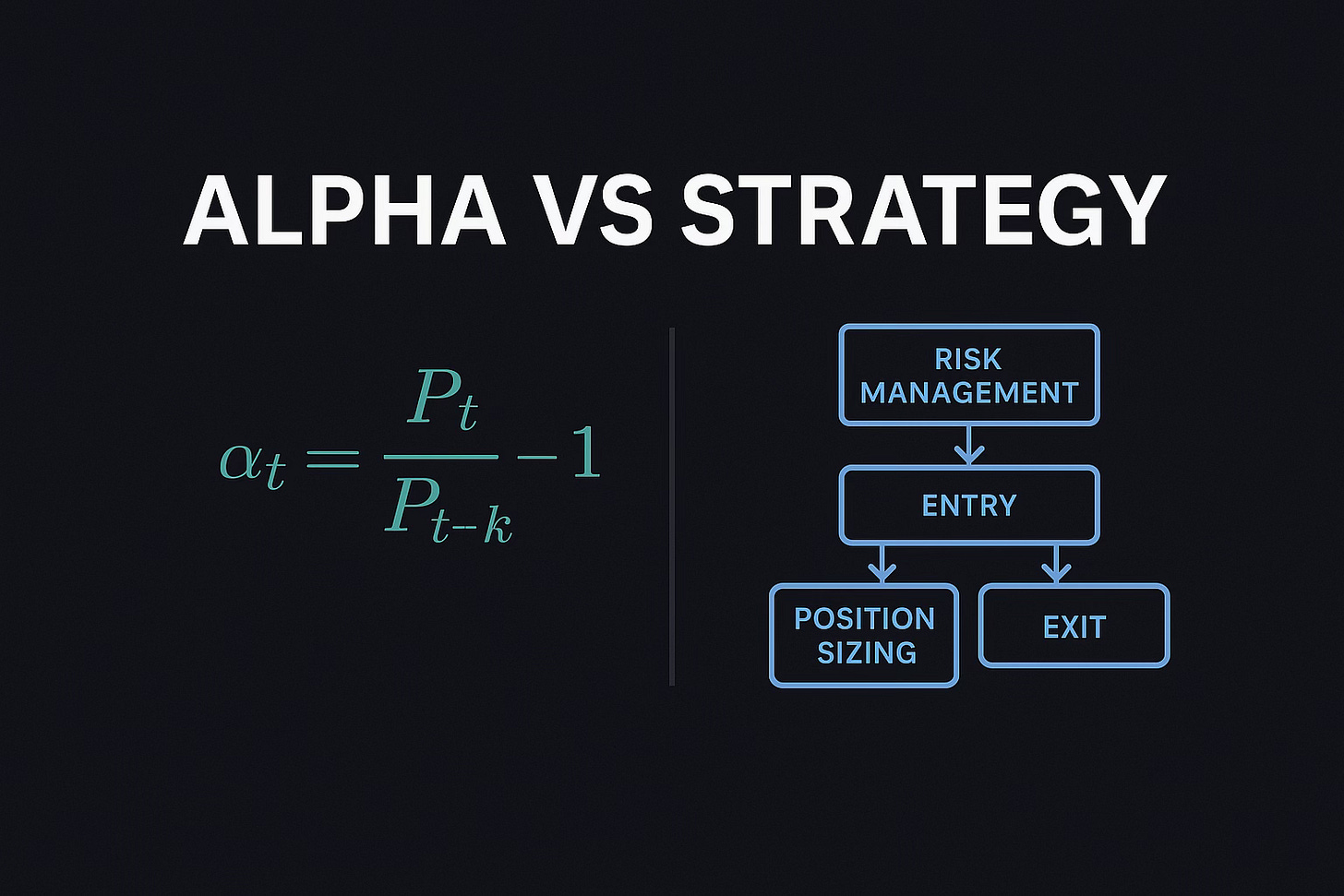

In quantitative trading, one of the most common misconceptions is to confuse an alpha with a strategy. While they are related, they are not the same.

An alpha is a formula, equation, or model that explains or predicts a specific market variable, such as returns, volatility, or momentum. A strategy, on the other hand, is a complete framework that combines multiple alphas with risk management, execution rules, and position sizing.

Alphas are building blocks, but only strategies make money.

2. What is an Alpha?

An alpha represents a hypothesis about market behavior, often expressed as a mathematical formula or model. It seeks to capture a relationship, like persistence, mean reversion, or asymmetry, that can potentially be exploited.

Example: k-day momentum

Observation : assets that perform well often continue to outperform.

Possible cause : institutional underreaction bias.

Formula:

\(\alpha_t = \frac{P_t}{P_{t-k}} - 1\)

Alphas can target returns, volatility, order flow, or other market properties. But by themselves, they are just signals, informative, but not tradable in isolation.

3. What is a Strategy?

A strategy is the architecture that puts alphas into action. It integrates multiple layers:

Signal generation: alphas such as momentum, volatility regimes, or skewness.

Risk management: volatility targeting, drawdown control, leverage limits.

Entry & exit rules: when to trigger trades, how to exit positions.

Position sizing & portfolio construction: how much to allocate, across which assets.

In practice, professional trading strategies use dozens or hundreds of alphas simultaneously.

The robustness comes not from a single elegant formula, but from combining diverse signals within a well-structured system.

4. Why the Distinction Matters

Confusing an alpha with a strategy often leads to disappointment. A model that looks powerful on paper may fail in live trading if it lacks context, risk management, execution, and portfolio integration.

This is why top hedge funds and prop firms don’t rely on “one alpha.” They cultivate an ecosystem of alphas, continuously testing, refining, and combining them into full strategies.

Alphas = insights.

Strategies = profitable systems.

5. Practical Takeaway

An alpha is a building block: a formula or model that captures a potential edge.

A strategy is the complete system: combining alphas, risk controls, and execution.

The path from alpha to strategy is what separates research from trading.

If you’re only building alphas, you’re doing research. If you’re integrating them into a strategy, you’re trading.

👉 If you want to go deeper into each step of the strategy building process, with real-life projects, ready-to-use templates, and 1:1 mentoring, that’s exactly what the Alpha Quant Program is for.